reit dividend tax uk

A UK-REIT is either a company or group that carries on a. REIT dividends and UK tax Scrip dividends IR contact information FAQs IR calendar Regulatory news Share price Open link menu.

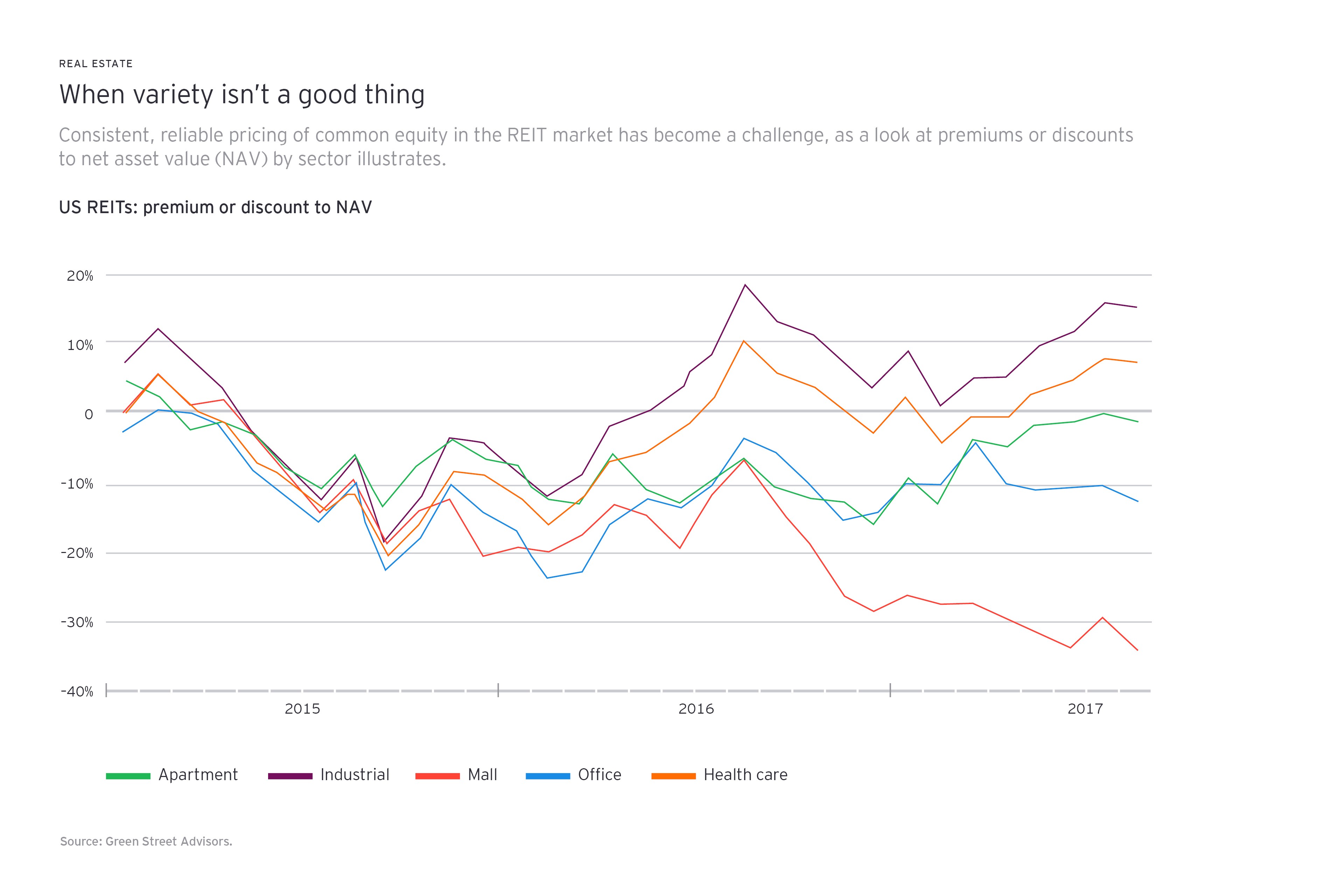

Reits Real Estate Investment Trusts Explained

A normal UK company is required to pay Corporation Tax on profits at a rate of 19.

. Delayed share data provided by. You do not need to pay taxes on dividends you generate from your individual savings accounts ISAs. EPIC Name Market Cap m Dividend Price to Book Sectors.

Youll need to fill in. A REIT are not eligible for the annual dividend tax allowance which is 2k in 202122. REITs benefit from some pretty special tax advantages.

Tax rate on dividends over the allowance. The main tax implications of electing for REIT status are. Advantage 3 - Tax Efficiencies.

To work out your tax band add your total dividend income to your. It offers exposure to a portfolio of Urban and Big box warehouses in Europe with a combined value of 184b. A quick guide to things to think about with regards to UK dividend tax rates in 2020.

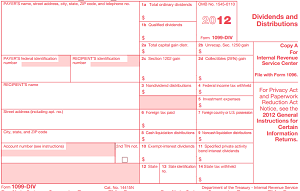

To qualify as a REIT the company must have at least 90 of its taxable income distributed to shareholders annually in the form of dividends. The majority of REIT dividends are taxed up to the maximum rate of 37 percent as ordinary income plus a separate 38 percent investment income surtax. How REIT Dividends Are Taxed.

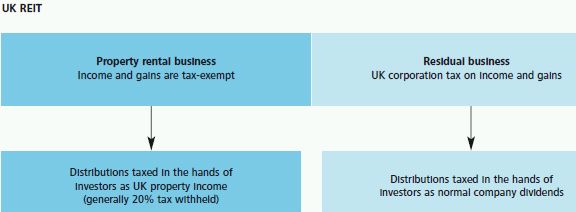

Please remember that I am not a tax advisor so you need to speak to HMR. Part 12 of the Corporation Tax Act 2010 provides for a special tax regime for Real Estate Investment Trusts UK-REITs. The net amount of cash received 80 in the example at GREIT08515 SAIM20000 is shown in.

A corporate shareholder or a shareholder treated as a company for treaty purposes wherever tax resident who holds 10 or more of the shares or voting rights in a UK REIT is regarded as. For individuals who do receive tax returns the PID from a UK-REIT is included as other income. The REIT is required to invest mainly in property and to pay out 90 of the profits from its property rental business as measured for tax purposes see IFM22050 as dividends to.

If you have received over 10000 in dividends in the tax year. Our REITS Table shows 45 UK-listed REITs Click on the REIT to see more Yahoo Finance Data. Please note that the tax-free dividend allowance does not apply to the PID element of the dividends.

Any non-PID dividends will be treated the same as ordinary. Income profits and capital gains of the qualifying property rental business of the REIT are exempt from corporation tax. You do not need to tell HMRC if your dividends are within the dividend allowance for the tax year.

The largest UK REIT is Segro SGRO with a market cap of 124b. REIT dividends and UK tax Scrip dividends IR contact information FAQs IR calendar Regulatory news Share price. Hence you do not need to pay taxes on the REIT dividends you get from your ISA.

Investor After tax return from UK company After tax return from UK REIT Enhancement of return UK.

Reit Dividends And Uk Tax Assura

Tax On Reit Dividends And Uk Dividend Tax Panda Boss

3 Tax Smart Alternatives Cohen Steers

Real Estate Investment Trusts Tax Implications For Investors

How Dividend Reinvestments Are Taxed

Reits Tax Consequences For Shareholders Hansteen Holdings Plc

A Short Lesson On Reit Taxation

How Reit Regimes Are Doing In 2018 Ey Global

Understanding The Reit Taxation Rules Novel Investor

Uk Reits Property Investing Like A Boss Foxy Monkey

.png)

Are These The Best Reit Stocks Etfs In The Uk Ig Uk

Uk Reits A Summary Of The Regime Fund Management Reits Uk

5 Popular Uk Reits Among Investors In October 2022

Two Harbors Investment Corp Announces 2021 Dividend Tax Information

10 Best Value Reits For Income Investors Kiplinger

Uk Dividend Tax 2020 Reit Dividends Tax Us Stocks Etc Youtube